Online gambling is a form of entertainment where individuals can place bets and wager money on various games and activities...

Slot Ripe Rewards Online - In the ever-growing landscape of online slot games, there's one title that stands out like...

Sejarah Ying Cai Shen adalah judul permainan slot yang mengambil inspirasi dari mitologi Tiongkok. Dalam bahasa Tionghoa, "Ying Cai Shen"...

Sejarah Gate of Olympus adalah salah satu permainan slot yang dikembangkan oleh Pragmatic Play, sebuah penyedia perangkat lunak perjudian online...

Live Casino Games refers to an online gambling platform where players can participate in various casino games that are hosted...

Upaya Memenangkan Judi online adalah praktik perjudian yang dilakukan melalui internet menggunakan situs web, platform permainan, atau aplikasi khusus. Ini...

Development Gate of Olympus is likely a reference to a specific slot game title, typically found in online casinos. Slot...

Apintoto: Bandar Togel Online Tergacor dan Terpercaya 2024 Apintoto telah menjadi salah satu nama terkemuka dalam industri togel online di...

Pemahaman Mendalam Mengenai Togel adalah singkatan dari "Toto Gelap", sebuah permainan judi yang sangat populer di beberapa negara, terutama di...

Golden Jade Slot Online In the realm of precious gems and minerals, few hold the allure and mystique of Golden...

Duel Dice Judi Online is a captivating dice game that combines elements of strategy and luck. Originating from ancient times,...

Membandingakan Perbedaan Live Kasino adalah tempat hiburan yang menawarkan berbagai macam permainan judi dan kesempatan untuk bertaruh uang dalam berbagai...

MAELTOTO - Situs Togel Online Dengan Berbagai Permainan TergacorKKRC300MAELTOTO adalah sebuah situs togel online yang terkenal dengan berbagai permainan tergacor....

Judi online Permainan Terbaik adalah praktik berjudi yang dilakukan melalui internet menggunakan perangkat seperti komputer, smartphone, atau tablet. Ini mencakup...

Permainan Togel Menguntungkan Masyarakat adalah singkatan dari "Toto Gelap" yang merupakan permainan judi yang populer, terutama di beberapa negara Asia...

Menebak isi Permainan Roulette adalah salah satu permainan kasino yang paling terkenal dan banyak dimainkan di seluruh dunia. Permainan ini...

Kepopuleran Majong Ways III adalah judul dari sebuah permainan slot yang dikembangkan oleh provider game slot tertentu. Permainan slot ini...

Steam Punk Slots Online In the realm of online casino gaming, Steam Punk-themed slots have carved out a distinctive niche,...

Memahami Fenomena Slot Online, Dalam era digital yang terus berkembang, industri perjudian online telah menjadi salah satu sektor yang paling...

Gate Of Olympus Kakek Zeus mungkin mengacu pada karakter mitologi Yunani, yaitu Zeus, yang merupakan salah satu dewa utama dalam...

Bermain slot adalah pilihan permainan yang bisa menjadi pilihan yang menyenangkan untuk beberapa alasan, tetapi penting untuk diingat bahwa keputusan...

Dragon Tiger Merajut Kisah, sebuah permainan kartu yang populer di kasino Asia dan semakin mendapat pengakuan di seluruh dunia, menjanjikan...

Taman Fantasi adalah permainan slot online yang mempersembahkan pengalaman bermain yang menakjubkan di dalam dunia yang dipenuhi dengan keajaiban dan...

Dunia Permainan Slot Pragmatic, Dalam industri perjudian online, Pragmatic Play telah menjadi salah satu nama yang sangat dihormati dan dikenal...

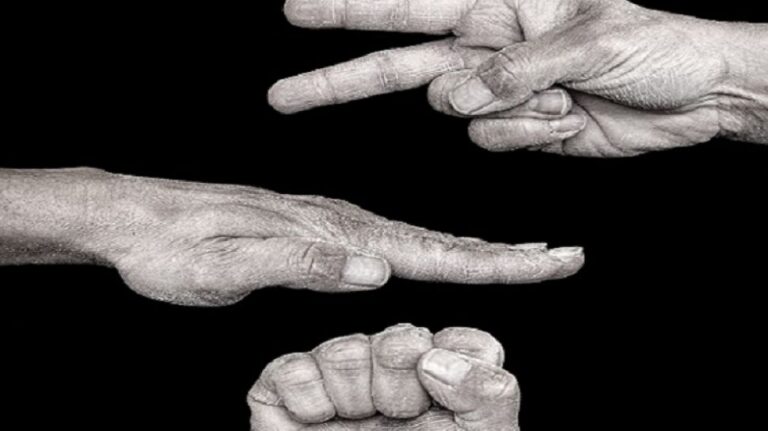

Transformasi Revolusi Suit Online Dalam era digital ini, transformasi bisnis tidak terbendung oleh batas-batas geografis. Salah satu sektor yang mengalami...

Keajaiban Microgaming Slot Online , sebagai salah satu penyedia perangkat lunak perjudian terkemuka, telah menciptakan sejumlah permainan slot online yang...

Memahami Ketenaran Zeus Slot adalah salah satu permainan slot yang menggabungkan keajaiban mitologi Yunani dengan kegembiraan perjudian modern. Dengan tema...

Membongkar Misi Keberuntungan Slot - Mesin slot gambling telah menjadi simbol ikonik di dunia kasino, menarik pemain dengan kilau lampu...

Cara Menang Secara Realistis di Toto Slot Tanpa Curang - Mayoritas penjudi bermain toto slot roda4d online hanya mengandalkan keberuntungan...

Cara Kerja Bisnis Judi Online yang Perlu Anda Ketahui - Perjudian online adalah industri yang besar, dengan jutaan pemain yang...

Insider Tips to Become a Successful Poker Player - If you are someone who loves playing online poker and other...

Why Online Slots Are So Popular - If you're a fan of online slots, play online bingo regularly, or just love the...

Alasan Kenapa Slot Online Begitu Populer - Jika Anda penggemar slot online, bermain bingo online secara ruti , atau menyukai kombinasi slot...

How to Understand Reverse Implied Odds in Poker - There are a lot of poker concepts you need to learn in order...

Cara Memahami Peluang Tersirat Terbalik dalam Poker - Ada banyak sekali konsep poker yang perlu Anda pelajari agar bisa membawa permainan poker...

How to Beat Side Bet Blackjack 21+3 - Offline blackjack spiced up with poker games in short is side bet blackjack 21+3....

Cara Mengalahkan Side Bet Blackjack 21+3 - Blackjack offline yang dibumbui dengan permainan poker singkatnya itulah side bet blackjack 21+3. Terinspirasi oleh...

How to Handle Variance in Poker Gambling - To succeed in poker, one must learn various strategies, master the use of poker...

Cara Menangani Varians dalam Judi Poker - Untuk berhasil dalam poker, seseorang harus mempelajari berbagai strategi, menguasai penggunaan perangkat lunak poker ,...

Best Skill Based Games You Should Play - Luck-based games will keep thrill-seekers entertained when they start playing. But is gambling...

Permainan Berbasis Keterampilan Terbaik yang Harus Anda Mainkan - Permainan yang mengandalkan keberuntungan akan memberikan hiburan bagi para pencari sensasi saat mulai bermain....